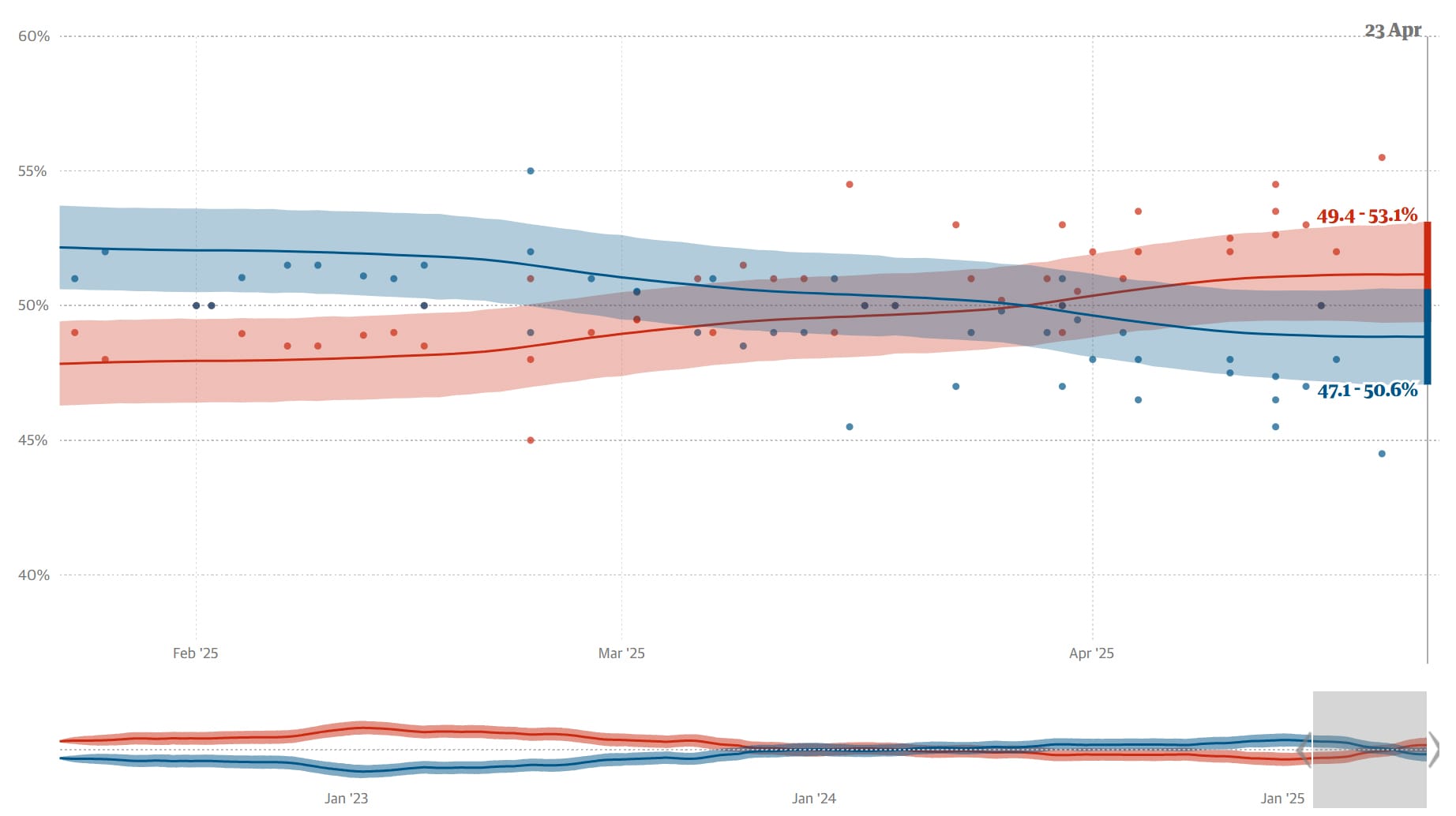

Where the numbers sit this week

A flurry of national polls dropped in the past seven days and—while the margins vary—they all point the same way: Labor is in front, but not far enough ahead to sleep soundly.

| Poll | Fieldwork | 2PP | Primary (% L/Coa/Grn/Ind) |

| YouGov | 11-15 Apr | 53 – 47 | 33 / 33 / 13 / 9 |

| Newspoll | 14-17 Apr | 52 – 48 | 34 / 35 / 12 / 12 |

The Guardian’s poll tracker averages out with a national two-party preferred of 49.4-53.1% Labor, 47.1-50.6% Coalition—a wafer-thin cushion once sampling error is considered.

Early voting opened the same day the third leaders’ debate went to air. The Australian Electoral Commission says more than half a million ballots had been cast in the first few hours, a pace comparable with 2022. Early voters tend to be a shade older and more conservative, so headline numbers can wobble on election night as pre-polls are counted last.

What we learnt from the second and third debates

No official winner was declared in last week’s second debate, and most commentators called it a draw. Housing affordability and rental stress dominated, followed by clashes on cost-of-living and a spirited debate over nuclear energy. Albanese was judged clearer on housing detail. Dutton was more aggressive on immigration and energy security. Neither leader did enough to move the dial however.

For the third debate, a Channel 9 journalist panel split 2–1 for Peter Dutton, giving the Opposition Leader his first “win” of the series. His fuel-excise cut and $1,200 tax rebate landed well with the studio audience, while Albanese leant heavily on falling inflation figures and Labor’s social-housing pipeline. The tone turned personal when each was asked about “the biggest lie told about you”.

Did the sparks move votes? Not obviously. The YouGov sample taken entirely after the third debate still showed Labor +0.5 on the previous week, reinforcing the view that entrenched narratives (cost of living and housing) outweigh debate theatre.

Cost of living is still the number one issue

Vote Compass responses released 20 April confirm cost of living sits comfortably at the top of voters’ worry list. A quarter of respondents said it is their single biggest concern; housing and climate came a distant second and third.

Roy Morgan’s January–March 2025 rolling survey told a similar tale: 57% nominate “keeping day-to-day costs down” as a top-three election issue, up seven points since mid-2022.

What hurts most?

According to an ABC analysis, disposable incomes have fallen faster in Australia than in any other OECD nation over the past two years, thanks to sticky food inflation, double-digit energy bill hikes and thirteen RBA rate rises since 2022.

The rival prescriptions

Labor

- $150 winter energy rebate for households and SMEs

- Two rounds of stage-three-lite tax cuts (from July 2025)

- 5% deposit Help-to-Buy scheme plus expanded rent assistance

Coalition

- 12-month halving of the fuel-excise (worth ≈$700 to an average family based on a 55 litre tank)

- A one-off $1,200 tax offset for incomes $48k to $104k

- Temporary 25% migration cut to “ease pressure on prices and housing”

Polling on trust shows the brutal reality that the public has little confidence in either party to address the crisis. Ipsos reported a poll in which only 38% of people trusted either Labor or the Coalition to tackle cost of living. Similarly, a Newspoll survey showed Labor with 31% and the Coalition with 28% of respondents believing they would best manage the rising cost of living. Hardly a ringing endorsement either way.

Housing crisis is the second issue

Housing has leap-frogged climate change among under-40s and is now mentioned by 72% of voters as important to their ballot choice. PropTrack’s March index showed that median house prices at a record high after a 3.9% annual gain. On the rental side, CoreLogic notes a 36% surge since COVID, leaving middle-income tenants spending a third of pre-tax pay on accommodation.

What the major parties are offering

| Headline measure | Labor | Coalition |

| Social / affordable supply | $10 bn Housing Australia Future Fund (30,000 homes in 5 years) | $5 bn infrastructure pot to unlock 500,000 lots |

| First-home help | 5%-deposit guarantee & 30–40% shared-equity | Up to $50k super withdrawal + mortgage-interest tax deduction |

| Rent relief | 27% real increase in Commonwealth Rent Assistance | Migration cut; lower APRA lending buffer |

| Foreign buyers | Two-year ban on existing homes (bipartisan) | Same ban |

Economists at Grattan Institute warn both parties’ demand-side carrots risk pumping prices unless matched by faster planning approvals and a larger build-to-rent sector. Tenants’ groups argue neither side will touch negative gearing or the CGT discount—measures widely seen as turbo-chargers of investor demand.

Voter mood

Focus-group work for the Guardian finds that even the Coalition’s super-for-housing idea—popular in 2022—now draws scepticism from younger renters who fear it will simply bid prices higher. Pollsters report a growing “policy over party” mindset: 54% say they are more likely to vote for any candidate with a credible social-housing expansion plan, regardless of banner.

Why these two crises matter for the final 9 days

Taken together, cost-of-living and housing crises would usually count against the incumbent government. Yet Labor’s edge in headline polls suggests its rebates, tax cuts and social-housing narrative are still resonating just enough— helped by a 1½-point fall in quarterly inflation and a tight labour market. The Coalition hopes its larger tax offset and petrol price relief can swing enough outer-metro and mortgage-belt seats.

The wildcards?

- March quarter CPI (out 24 Apr). A surprise uptick would punch holes in Labor’s “inflation heading south” line.

- Fourth and final leaders’ debate (27 Apr). A decisive win—particularly on cost pressures—could shift late deciders.

- Early-vote dynamics. If pre-poll turnout runs at higher than usual levels, late campaign swings could be muted, locking in today’s narrow Labor lead.

Final thoughts

Beware surface swings. The electorate’s headline mood is volatile, yet the underlying hierarchies of concern (cost of living, housing) have hardly budged in 18 months.

Policy specificity counts. Voters can tell a rebate from a structural reform and are punishing rhetoric not backed by numbers.

Independents remain the pressure valve. Their share of primary support—9–10% nationally—is small but heavily concentrated in high-income urban seats where housing stress (renters vs. million-pound mortgages) is acute. Where the exact share of votes goes, including preference votes, could still swing the outcome.